Hear about JaTio’s Journey After Habitat

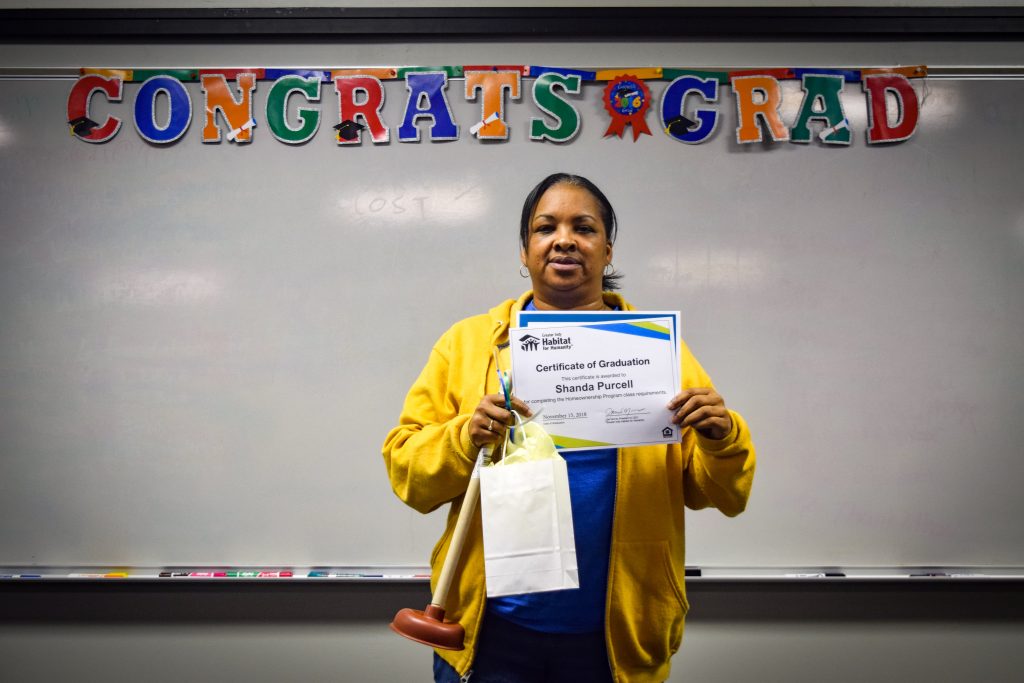

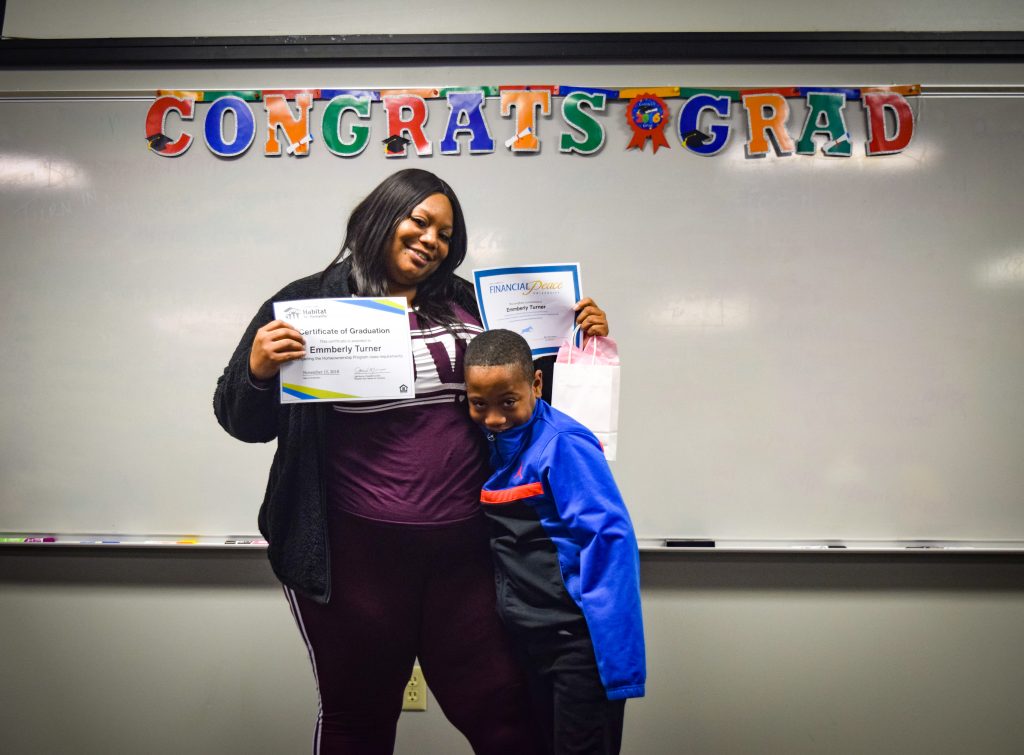

In 2019, JaTio Skinner achieved a remarkable milestone—she became a proud first-time Habitat homeowner. JaTio, along with her now 9-year-old son, helped build her home as part of the Agriculture Build hosted at the Indiana State Fair. Dedicated to her dream of homeownership, she completed the homeownership education program while working full-time night shifts and being a single mother.

While in the homeownership program, Habitat University, JaTio didn’t just secure a home; she also completed her associate degree at Ivy Tech. This experience gave her the inspiration she needed to continue her education and transfer to the IUPUI Kelly School of Business to earn a bachelor’s degree in HR Management. “I knew I could do anything if I could do this,” she reflects.

When asked about the role her Habitat home played in her life, JaTio responds, “Everything!” The sense of responsibility and independence she gained from homeownership is invaluable. Financial literacy courses through Habitat University equipped her with the skills to be credit-savvy and financially efficient. Describing the experience as “amazing,” JaTio emphasizes that owning a home brings a sense of peace, as she redirects her money back into her own investment instead of rent.

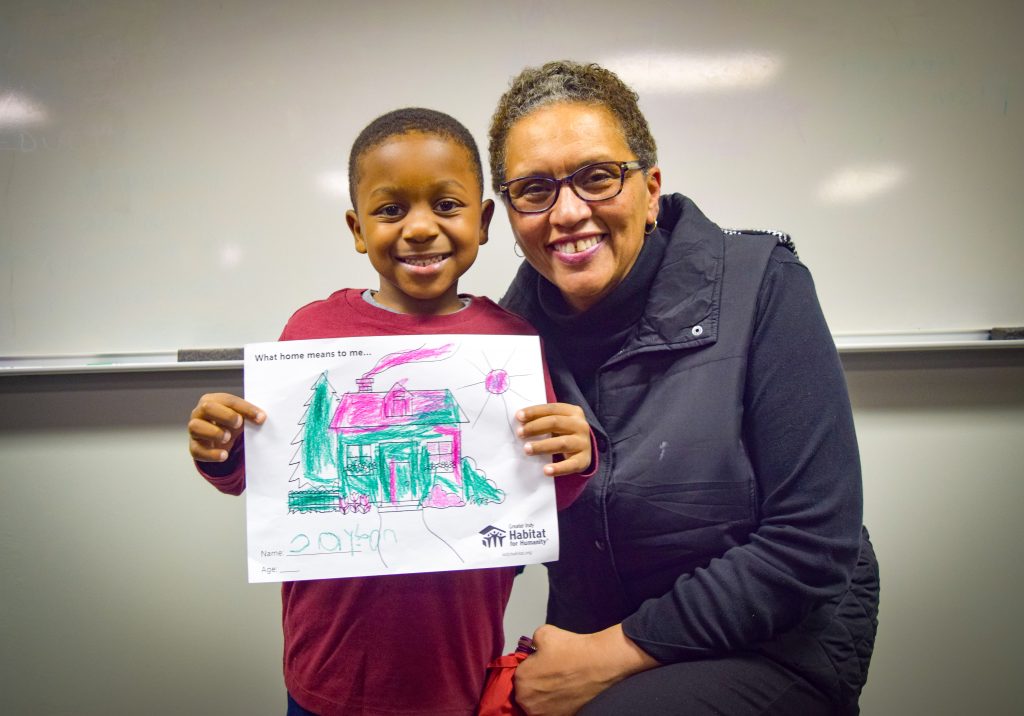

Her neighborhood is becoming a close-knit community where her son can play freely. Since partnering with Habitat, JaTio notes so many positive accomplishments in her life. Not only did she gain financial stability, but she also feels the program helped her build character.

One of JaTio’s fondest memories about Habitat is the care she received from the team. Now comfortable in her home, she has started a new tradition—Christmas Eve pajama parties, where family and friends gather to celebrate the holidays.

JaTio hopes her journey is an inspiration and she encourages others considering homeownership to believe in themselves. For her, the right mindset and the right commitment are key. “See it, then achieve it. Imagine yourself on closing day cutting that ribbon. It’s hope that will get you there. It can be done; I did it.”

Meet Bugashane Mugoovi, a promising first-year student at Purdue University, starting his academic journey in Computer Graphic Tech and UX Design. He gained a passion for computer design and software his first semester and was happy his major aligns with his interests. Hoping to make his parents proud, Bugashane chose Purdue because of their prestigious programs and to fulfill a dream of his own.

Meet Bugashane Mugoovi, a promising first-year student at Purdue University, starting his academic journey in Computer Graphic Tech and UX Design. He gained a passion for computer design and software his first semester and was happy his major aligns with his interests. Hoping to make his parents proud, Bugashane chose Purdue because of their prestigious programs and to fulfill a dream of his own.  Kali Negussie is pursuing her second bachelor’s degree, this time in nursing at IUPUI. Having completed her undergraduate studies in psychology and human development at Purdue University last spring, Kali’s decision to transition to nursing stems from a desire to build

Kali Negussie is pursuing her second bachelor’s degree, this time in nursing at IUPUI. Having completed her undergraduate studies in psychology and human development at Purdue University last spring, Kali’s decision to transition to nursing stems from a desire to build  Wisdom Korrie is on a promising journey as a first-year student at Ivy Tech. His pathway to Ivy Tech started through the Dream Alive program and a campus tour.

Wisdom Korrie is on a promising journey as a first-year student at Ivy Tech. His pathway to Ivy Tech started through the Dream Alive program and a campus tour.  Meet Alexis Adams, a tenacious junior at IUPUI on the journey of forensic science. Raised in the nurturing environment of her Habitat home since the age of three, Alexis has not only excelled academically but also has a deep passion for true crime and chemistry.

Meet Alexis Adams, a tenacious junior at IUPUI on the journey of forensic science. Raised in the nurturing environment of her Habitat home since the age of three, Alexis has not only excelled academically but also has a deep passion for true crime and chemistry. (Precious and her son, Karachi, volunteering on a Habitat build site.)

(Precious and her son, Karachi, volunteering on a Habitat build site.)