Start by requesting and completing an information session video.

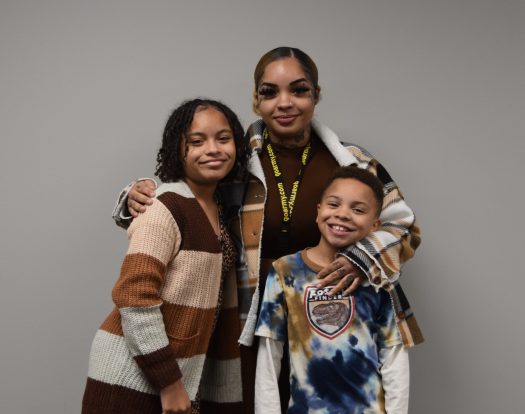

Homeownership builds stability & independence for local households.

Habitat is a HUD-approved Housing Counseling Agency. With support from volunteers, donors and the community, we provide a quality, affordable homes for first-time buyers in Indianapolis.

How is Habitat different from a traditional mortgage?

With a 42% increase in home values since the summer of 2020, supply of affordable homes is at record lows for first-time buyers. Wages continue to lag behind these price increases.

Habitat homeowners have an affordable mortgage, currently with 0% interest, pay modest closing costs and complete 200 partnership hours including homeownership classes through Habitat University, construction on their home and the houses of other future Habitat homeowners.

What can I gain from homeownership?

Housing is important to the quality of life, health, and economic prosperity of the entire community.

70% of homeowners indicated the lives of family members are better since becoming homeowners and 70% also attribute Habitat’s homeownership program to positive changes in their families’ lives. 79% of homeowners completed, started, or planned to complete higher education or training programs since becoming a homeowner.

Parents also observed improved study habits, increased academic achievement, and more consistent school attendance. 56% of homeowners reported improved mental health and feeling optimistic about the future. Financial security, household savings, and the ability to manage unexpected expenses all increased more than 35% after purchasing a Habitat home.

What does a Habitat home look like?

We’re committed to building high-quality homes that remain affordable for families. Our home designs include both one- and two-story options, thoughtfully built to meet the needs of our homeowner.

Through strong partnerships, we prioritize quality materials and skilled service, ensuring every home is built with care and lasting value.

Follow us on social platforms to stay up to date on stories of our work and home closings.

How do I prepare myself to qualify for Habitat?

Discover if Habitat homeownership is right for you by viewing our online information session video. The video outlines income guidelines, program requirements, and details to follow to prepare for the application process.

Many families face obstacles when preparing for homeownership, which is why we’re launching Road to Readiness—a program designed to help applicants who might not yet qualify for a mortgage. Still unsure where you stand after completing the information session video? We want to help!

Frequently Asked Questions

Habitat homeowners are chosen without regard to race, color, religion, gender, national origin, familial status, disability, marital status, ancestry, sexual orientation, source of income or other characteristics in keeping with U.S. law and with Habitat’s abiding belief that God’s love extends to everyone. Habitat also welcomes volunteers from all faiths, or no faith, who actively embrace Habitat’s goal of eliminating poverty housing from the world.

Habitat builds homes in partnership with those in need regardless of race, color, religion, gender, national origin, familial status, disability, marital status, ancestry, sexual orientation, source of income or other characteristics protected by law. The prospective homeowners must meet three criteria: need, ability to repay the mortgage and a willingness to partner with Habitat.

You may only carry forward tax credits if your tax liability is less than the tax credit amount in a given year. For example, if you have $10,000 in tax credits and you only have $8,000 in tax liability, then you may carry forward the diƯerence of $2,000 in tax credits for up to 5 years until you expend all of the credits. Credits are expended based on the year they were acquired; older tax credits must be used before new tax credits may be applied.

Yes, you may be able to use multiple tax credits, but you should consult with your tax professional to be sure you understand the limits on any other tax credit program you are participating in. Donors are only allowed a maximum of $10,000 per tax year for the Attainable Homeownership Tax Credit.

Housing studies show affordable housing has no adverse effect on neighborhood property values. In fact, the recent social impact study done on the Habitat homeownership program shows that a home increases the property value of surrounding homes.

Greater Indy Habitat for Humanity provides equal housing opportunities for all and ensures fair and equal access to its programs and services regardless of race, color, religion, gender, national origin, familial status, disability, marital status, ancestry, sexual orientation, source of income, or other characteristics protected by law.