Kara Abstone moved into her Habitat home in 2000 when her daughter, Karrington, was just a baby. “I started (Habitat) classes when she was just one week old! They called her the Habitat baby,” remembers Kara. Now, as Karrington finishes up her high school degree, her mom finishes up the final details of a bathroom remodel made possible through our new Habitat Home Improvement Program.

Kara Abstone moved into her Habitat home in 2000 when her daughter, Karrington, was just a baby. “I started (Habitat) classes when she was just one week old! They called her the Habitat baby,” remembers Kara. Now, as Karrington finishes up her high school degree, her mom finishes up the final details of a bathroom remodel made possible through our new Habitat Home Improvement Program.

In an effort to provide additional resources to Habitat homeowners to improve their quality of life, a gift from the Randall C. and Janet D. Belden Family Fund, a fund of The Indianapolis Foundation, helped fund the creation of our Home Improvement Program. Through this initiative, Habitat homeowners like Kara can fund home improvements such as HVAC replacement, accessibility or security additions, porch or patio repairs, and more, with a 0% interest loan up to $5,000.

“The goal of this program is to create affordable avenues for our homeowners to modify and improve their homes so they can live there as long as they would like,” said Jim Morris, Greater Indy Habitat president & CEO. “As reported in our recent 30-Year-Impact Study, more than 88% of homeowners shared that they plan on remaining in their current Habitat home for a long time or permanently. This program helps homeowners adapt their space so they can continue to grow into and enjoy it.”

Kara’s more spacious, orchid painted bathroom is an example of this opportunity to change and customize her home. The loan enabled a contractor to open up walls in the bathroom, replace the linoleum with tile, upgrade the shower and vanity, and replace the textured paint. With plum shower curtains on their way, Kara says her Pinterest board came to life. Karrington approves of the changes and even shared project progress with friends via FaceTime.

After 18 years of enjoying her home, Kara made her dream bathroom a reality, thanks to the Habitat Home Improvement Program.

Habitat homeowners interested in this program, please contact Janet at 317.777.6090.

Before Photos:

After Photos:

As we continue to adapt our services to meet the needs of our homeowners and the community, we were honored to have our owner-occupied repair program nominated for LISC’s Love Thy Neighborhood Awards this spring. In 2017 we provided 63 repairs to enable homeowners to remain in their home, and thus neighborhood, despite health, aging, or financial challenges.

The focus of the homeowner repair program is on exterior, health and safety, and energy efficiency repairs. Learn more about this program by watching the video below!

Meredith Canfield, Volunteer Manager, explains how we lift up our homeowners with tools and resources.

At Habitat, we have traditionally used the phrase, “we are a hand up, not a hand-out” as our unofficial missional mantra. Whenever I actually say that phrase out loud, my Hollywood film imagination visualizes hand up as a person being lifted up in the emotional, educational and physical sense. Picture this scene: a close up camera view of a person sitting in a chair with a clear indication that they need help determining a new direction for their life. [Cue inspirational music.] Then, with the camera panning the room from the perfect angle, you see a person put their arm around the individual to lift them up as they walk out of the scene together in hopeful pursuit of something better.

There are several ways that Habitat lifts up future homeowners prior them signing a 0% interest mortgage and receiving the keys to their new home! One of my favorite ways we lift up our homeowners is by providing Dave Ramsey’s Financial Peace University class. (This class is actually a personal love and passion of mine. You can read more about that in this blog post.) Our homeowners learn things like budgeting, saving cash for large purchases, getting out of debt, and even giving financially to others. Being burdened by the cost of high rent and a low income, obtaining financial peace may have once been a pipe dream for many of our homebuyers. By partnering with Habitat and learning skills taught by Dave Ramsey, our homeowners have an opportunity to feel financial peace and confidence as they make the mortgage payment each month for years to come.

There are several ways that Habitat lifts up future homeowners prior them signing a 0% interest mortgage and receiving the keys to their new home! One of my favorite ways we lift up our homeowners is by providing Dave Ramsey’s Financial Peace University class. (This class is actually a personal love and passion of mine. You can read more about that in this blog post.) Our homeowners learn things like budgeting, saving cash for large purchases, getting out of debt, and even giving financially to others. Being burdened by the cost of high rent and a low income, obtaining financial peace may have once been a pipe dream for many of our homebuyers. By partnering with Habitat and learning skills taught by Dave Ramsey, our homeowners have an opportunity to feel financial peace and confidence as they make the mortgage payment each month for years to come.

One thing my Hollywood imagination left out of the scene is the hard work that real life individuals live out after they are lifted up. While the short scene I described doesn’t paint the full picture of our mission’s mantra, the real life journey toward Habitat homeownership begins with a lift but continues down a path of hard work, pride, and success for each homeowner.

Want to read about success stories of Homeowners after they are in their home? Check out this blog post about Amy, Habitat Homeowner 2017.

For Amy and her son, Isaac, the feeling of being home for the holidays is a gift they will never take for granted.

For Amy and her son, Isaac, the feeling of being home for the holidays is a gift they will never take for granted.

After Amy’s husband returned from military service in 2008, their family life changed drastically. It was then that she moved back in with her parents.

After my husband came home from the war, we were faced with the challenge of living with his PTSD. He did not feel that he could be a part of our family anymore, and left both of us. Because of this, it was my turn to be ‘in need.’ My parents took us in and we began to heal.

Amy found out about Habitat for Humanity from a co-worker. She learned that her family was a perfect candidate for the program: first-time homeowner, a stable income and a willingness to invest time and energy to learn the facets of being a successful homeowner, while also helping to build her home. This year, Amy and her son Isaac are proudly spending their first holiday season in the comfort of their Habitat home. From the beginning of her Habitat journey, Amy knew her home would be a blessing that would extend to others…

I’m a single mom and I’m a social worker so there’s not a lot of money to be had. We were living with my parents and I felt called to expand our horizons and through homeownership reach out to other people as a good steward of that home. I wanted to be a good example to my son of how important it is to become a homeowner and what a great reward it is; to show him how to be hospitable to others and to be a part of the Kingdom in that way.

I’m a single mom and I’m a social worker so there’s not a lot of money to be had. We were living with my parents and I felt called to expand our horizons and through homeownership reach out to other people as a good steward of that home. I wanted to be a good example to my son of how important it is to become a homeowner and what a great reward it is; to show him how to be hospitable to others and to be a part of the Kingdom in that way.

Amy and her son, Isaac, have found strength and stability since moving into their new Habitat home. As a first-time homeowner, Amy has enjoyed new experiences that were not possible before. She has started hosting a small group from her church at her house, has welcomed Tucker, their new dog and says their home has become “that house” for where neighborhood kids gather.

I really like to cook so having my own kitchen has been nice! I love having family and friends over for dinner and the neighborhood kids are at my house 6 days a week! That has been the biggest blessing, getting to know my neighbors and to watch my son make good friends. We would never have had that if we did not move into our Habitat home.

This holiday season, help make “home for the holidays” a reality for more families. As you read this, another person just like Amy is pursuing the dream of homeownership through Greater Indy Habitat. Your gift today has the power to change a lives.

Providing insight to finding peace with finances, Meredith Canfield, volunteer manager, describes why Dave Ramsey’s course is a perfect fit for our homeownership program.

About four years ago, my church offered Dave Ramsey’s Financial Peace University (FPU) class. I thought, “I have time on my hands and I like the thought of financial peace. What could I lose?” That class changed my life. It changed the way I view wants and needs. It provided me a conversational foundation for all money talks with my now husband. And, most importantly, it gave me a new #1 on my list of top celebrities I want to meet one day: Dave Ramsey. But, let’s save that notion for a separate blog post for nerds like me who could actually appreciate it…

Once I started working through the plan and budgeting, it felt like an instant raise! Every dollar had a spot and I even had money to spare! I learned from FPU that peace can only be maintained if your money is kept in line by a well thought out plan – a budget. Similarly, our Habitat homeowners may feel like they got a raise because of the money they are saving from their affordable mortgage versus their expensive rent costs from the past. But, without a plan of what to do with that extra income or even the new costs associated with homeownership, how will they maintain the peace of financial freedom?

Baby steps.

Baby steps.

The theme of FPU’s baby steps perfectly aligns with our Homeownership Program. This is why we have chosen to provide it as part of the requirement to complete 300 hours of sweat equity. After all, the other side of slow and steady 300 hours of hard work feels more rewarding than a quick fix or even something free, doesn’t it? Overall, the completion of sweat equity hours provides a natural partnership between our homeowners and Habitat, a sense of pride when constructing on their own home and provides skills and knowledge they can use during their first year of homeownership and beyond.

While I am biased toward my love for budgeting, saving, and giving, I think the financial nuggets of information provided through FPU will change our homeowners’ lives just like it has for me. I hope and pray that our homeowners feel empowered by the lessons taught in Financial Peace University and always strive to plan for financial peace along their homeownership journey.

Many of us take for granted the ability to paint the walls of our home or customize our living spaces. Moving from apartment to apartment, whether for rising rent or a negligent landlord, means that renters are unable to personalize their space, even as simple as hanging family photos.

Our homebuyers often share that this ability to personalize their living space is something they specifically look forward to in owning their first home. Marina, a 2017 Habitat homeowner, shared photos of how she customized her living room with a music theme. She wrote: “I love the green I chose. It turned out so beautifully! It gives my music theme some Pizzazz! I just have to get another curtain rod, so I can put up my navy blue curtains.”

Check out her photos below!

Thanks, Marina, for sharing a peak into your home!

From the Desk of Jim Morris, President & CEO

You often here the phrase, “there ain’t no such thing as a free lunch.” In Habitat for Humanity parlance, we often talk about providing a hand up and not a hand-out. Our sense of fulfilling Jesus’s second greatest command of loving our neighbor with the understanding that our neighbor is also participating in some way, whatever means available. As we commemorate 30 years of fulfilling our mission to build homes, communities and hope, Greater Indy Habitat for Humanity has secured the ability to offer future home buyers another hand up that isn’t a free lunch, but is definitely a multiplier toward their efforts to successful homeownership.

In August, the Indiana Housing & Community Development Authority granted Greater Indy Habitat the ability to administer Individual Development Accounts (IDAs). Having an IDA program will allow future Habitat homebuyers to create a savings account for down payment assistance, matched 4:1 through state and federal monies toward savings goals. It is an opportunity to help build a savings mindset toward long-term homeownership success, while also providing a way for the homebuyer to obtain the up-front monies necessary for being a homeowner.

As part of our pre-buying, homeowner education process, we already walk homebuyers through financial education classes that emphasize credit, debt, or other issues that could prevent them from reaching their homeowner goals and long-term financial aspirations. Having the IDAs as a tool will only continue to benefit the homeowners in their journey to a better quality of life.

As part of our pre-buying, homeowner education process, we already walk homebuyers through financial education classes that emphasize credit, debt, or other issues that could prevent them from reaching their homeowner goals and long-term financial aspirations. Having the IDAs as a tool will only continue to benefit the homeowners in their journey to a better quality of life.

According to the latest data from the U.S. Bureau of Economic Analysis, the personal saving rate in the United States is 5.7%. Recently, GoBankingRates posed the question to more than 7,000 Americans of how much they had in their savings account. Nearly seven in 10 Americans (69%) had less than $1,000 in their savings account. Most low-income families would fall into this category as they can barely cover expenses let alone save money, so having another tool to provide them the opportunity to save and to invest in their long-term future feels to us like we are adhering to Jesus’s command.

Last month Indy Star columnist Matthew Tully stopped by one of our build sites in the Near North neighborhood to check out the action. Talking with Allegion volunteers, Tiger team members, staff, and our homebuyer, Terri Dorsey, Tully heard a 360 view of what goes into a Habitat home build.

“On a recent evening, Terri and her daughter drove by the home. They parked on the street and walked up to it, smiling as they talked about where different pieces of furniture would go. Terri’s daughter focused on the decorations she’ll have on her bedroom walls and a third member of the household she hopes will join them once they move out of their apartment.

‘In her mind, she already has a dog,’ Terri told me with a laugh. ‘Well, now she can have that dog she’s been dreaming about.’”

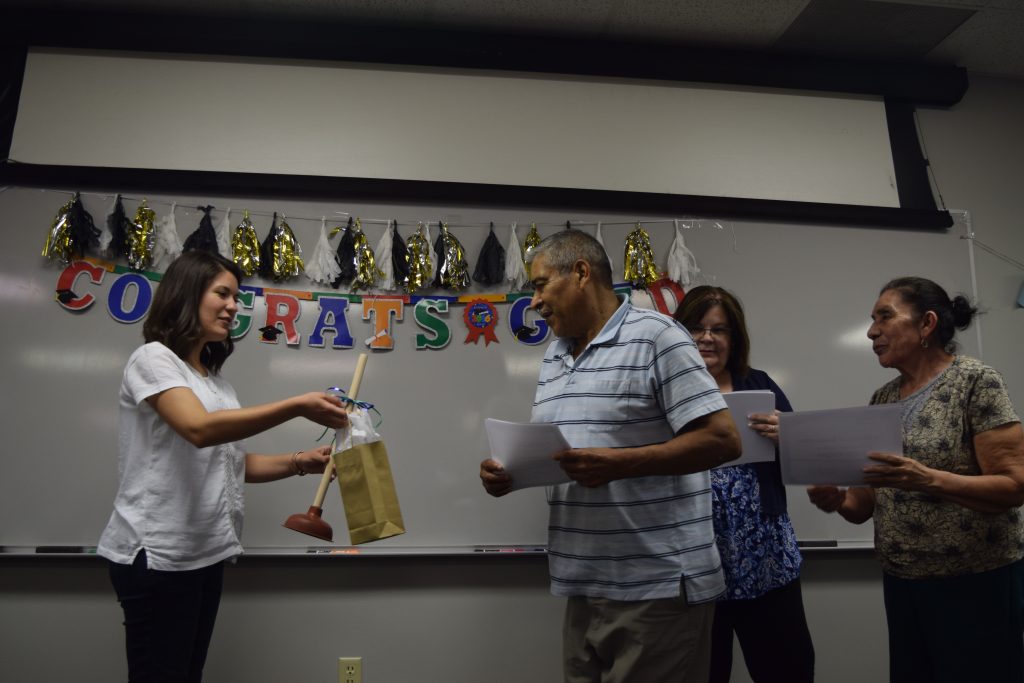

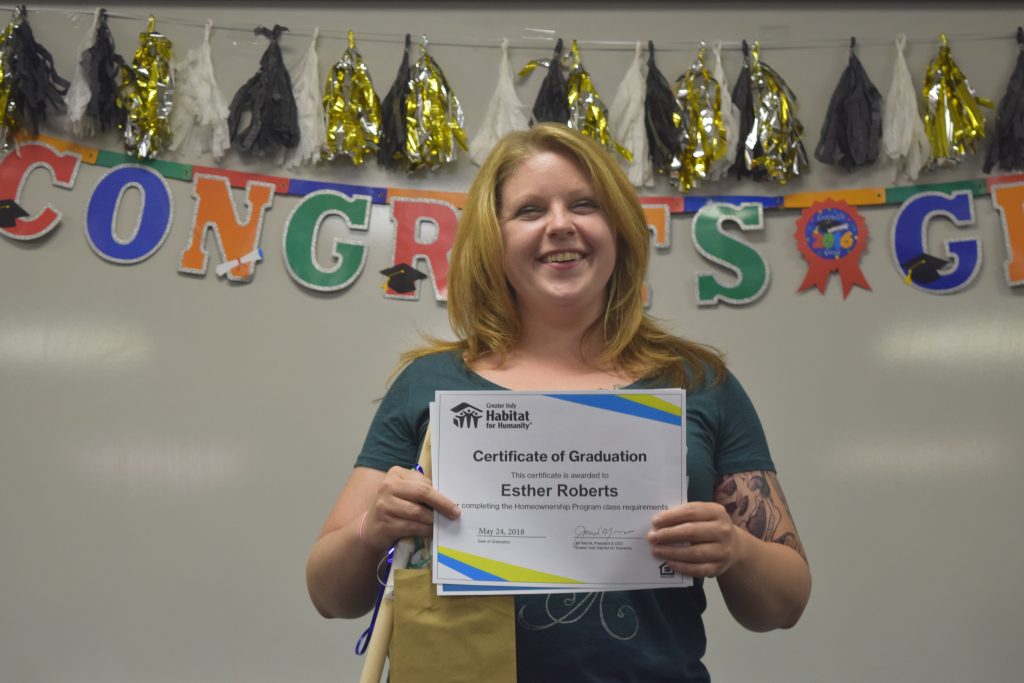

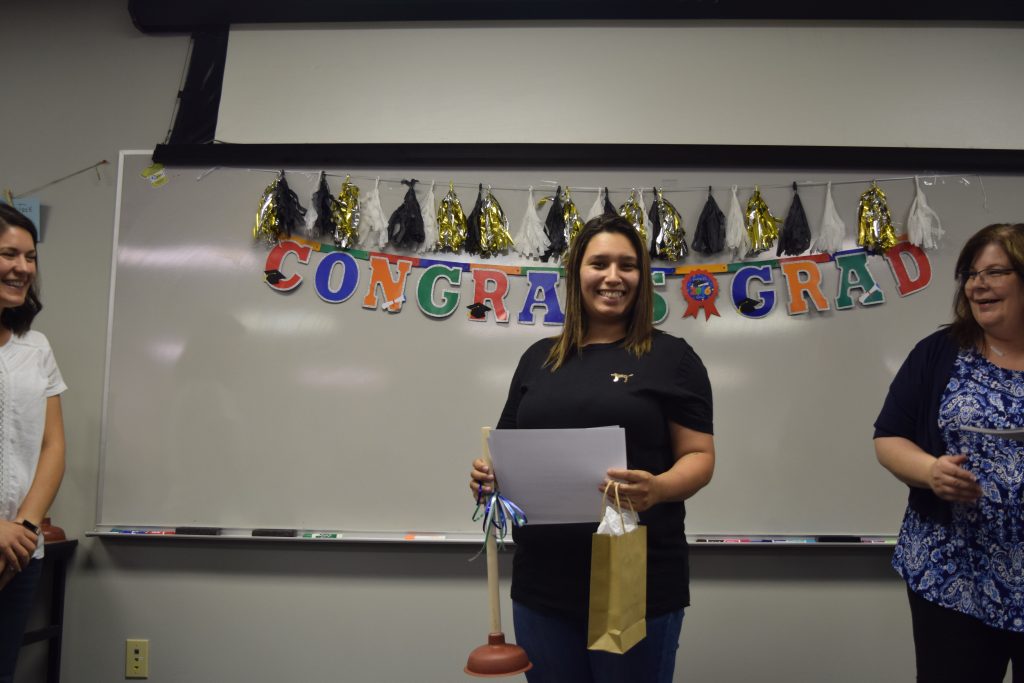

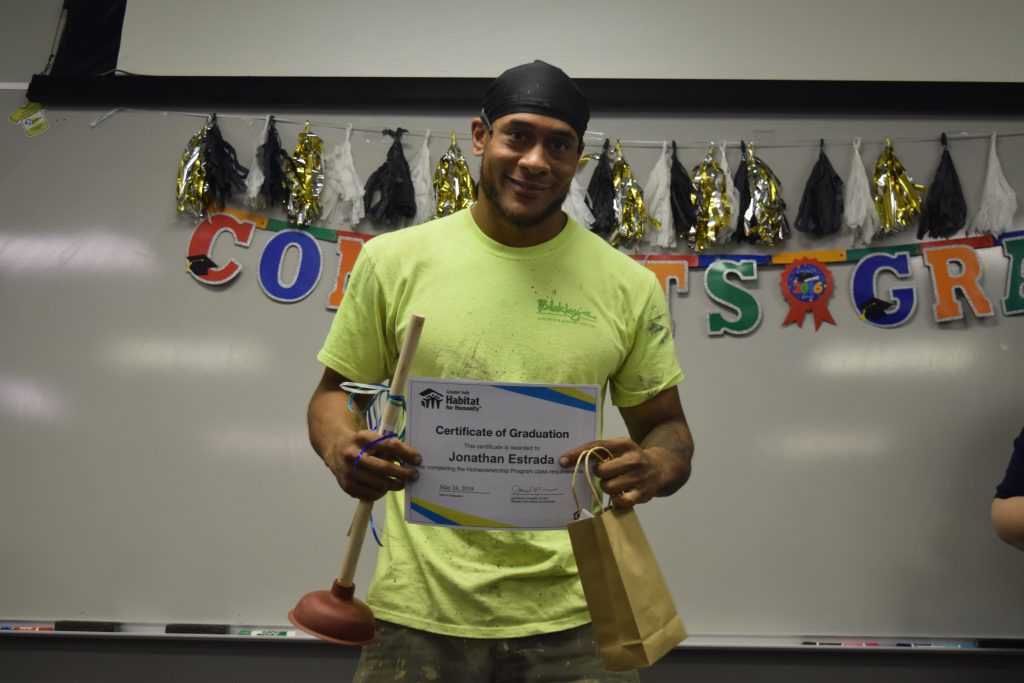

Congratulations to the most recent graduates of our homeownership education class! These 15 future homeowners completed a semester of classes to prepare them for the challenges and joys of Habitat homeownership.

Congratulations to the most recent graduates of our homeownership education class! These 15 future homeowners completed a semester of classes to prepare them for the challenges and joys of Habitat homeownership.

Each participant completed Dave Ramsey’s Financial Peace University to better prepare them for the financial planning involved with owning a home. Budgeting skills were refined and healthy spending habits were shared. Future homeowners also learned about homeowners insurance, taxes, appraisals, and legal issues related to owning a home.

The class completed maintenance courses to prepare them for building or rehabbing their Habitat house and taking care of it after they purchase it with a 0% interest mortgage. Habitat construction staff and community partners offered wisdom on potential challenges with plumbing, electrical, HVAC, and other areas. Homeowners were hands-on for demonstrations of painting, drywall, and hammering.

Next up: building/rehabbing their home alongside volunteers and partners, then purchasing their FIRST home!

We are seeking qualified applicants to our homeownership program and spots are still open for class this fall. Join us the first Thursday of every month for an info session to learn more or call Martha at 317.777.6086!